•Asset Valuation(资产评估)Any Asset Evaluation (PVFNI)(任何资产评估)

–Budgeting and Planning(预算和计划)

–Prospect Screening(项目筛选)

–Pre-Drill or Work-over Justification(钻前或作业前评价)

–Post Project Tracking(项目跟踪)

–Acquiring / Divesting Assets(资产并购/剥离评估)

–Determine the value of a single well, multiple wells or any grouping of assets.(确定单井、井组或任何资产组的价值)

–Determine the values pre and post income tax.(确定资产税前和税后的价值)

–Determine value for different “what If” cases.(确定资产在不同假设方案下的价值)

•Reserves Reporting (SEC, NI51-101,..)(报告储量(SEC, NI51-101,..))

–For internal and external reporting(对内对外报告)

–Measure reserves base in value (disc. & non-disc. $) and volume (net & gross) (从价值和体积两方面量化储量)

–Report, total and subtotal value and reserve volumes by any grouping(对任意单元的储量进行报告、汇总和部分汇总)

–Supports new SPE PRMS guidelines(支持新的SPE PRMS准则)

•Project screening(项目筛选)

–Quickly determine the valuation of varying PSA development projects(快速确定不同PSA开发项目的价值)

–Quickly determine the valuation of varying PSA terms(快速确定各种PSA条款的价值)

–Calculate partners or government cash flows (e.g. government take)(计算合作伙伴或政府的现金流(即政府拿走部分))

–Calculate company specific screening criteria.(计算公司特定项目的筛选标准)

•Pre-Drill/Work-over Justification(钻前/作业前论证)

–Compare potential projects based on consistent benchmarks(基于恒定的基准点对比潜在项目)

–Determine best project timing to maximize value(确定项目价值最大化的最佳时机)

–Create detailed cash flows with economic benchmarks for investors, banks and finance institutions(用经济基准点为投资者、银行以及融资机构建立详细的现金流)

•Post Project Tracking(项目跟踪)

–Determine updated economics as a project proceeds(项目进行过程中更新项目的经济性)

–Compare actual economics to original estimates (“Look-Backs”)(对比实际经济性和原始估算)

–Prepare project “Report Card” for management or investors(为管理层或投资者准备报告卡)

–Anticipate changes in outcome before they become critical. (在他们变成危险前预计结果的变化)

•Acquiring/Divesting Assets(资产并购/剥离)

–Determine risked, un-risked, pre-tax and post-tax valuations of assets or groups of assets.(确定资产或资产组的价值(风险的、无风险的、税前和税后)) –Determine effect of asset sales to risked, un-risked, pre-tax and post-tax valuations of remaining assets(确定资产买卖对剩余资产的价值影响)

–Prepare sales packages for distribution (PHZ)(准备发布的销售资料包)

–Evaluate costs of added burdens, production payments or other promotes(评估额外负担、产量付款或其它成本)

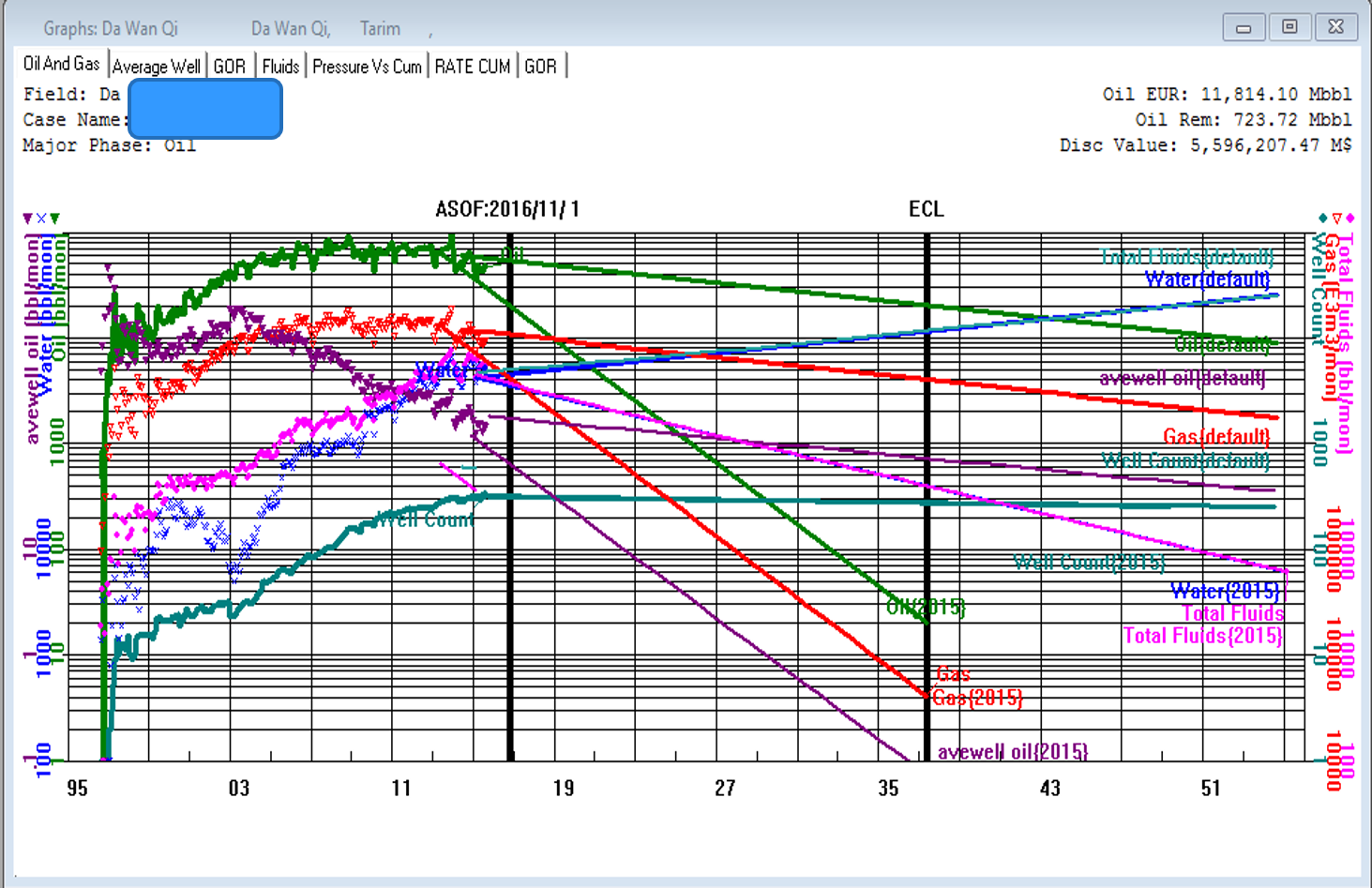

•Features - Decline Curves(PHDWin的功能-递减曲线)

–Truly integrated decline curve and economics(真正把递减曲线和经济性结合起来)

–Comprehensive Decline Curve projections(综合递减曲线预测)

–Rate Time, Rate cum, BHP/Z, etc –Dynamic Connection and Calculation

–Definable Variables & 42 variables work together

–Modified ARPs for conventional and non conventional –Multi segment for advanced modeling

–7 windows combined projection

•Features – Economics(PHDWin功能-经济评价)

–Flexible price, expense, investment and tax inputs(灵活的价格、费用、投资和税收输入)

–Automated depreciation and depletion calculations(自动折旧和损耗计算) –Expandable product, revenue, expense and tax streams(可延伸的产品、收益、费用和税收流建立)

–Investment grouping and tracking for capital budgeting(资本预算的投资组合和跟踪)

–Sophisticated ownership modeling - Automated Reversions, PSA modeling, multiple ownership decks(成熟的所有权模型建立-自动未来所有权益计算、PSA模型、多所有权平台)

–Flexible user buildable “Cash Formula” models for PSA & PSCs(用户可灵活的建立PSA&PSCs的现金流公式)

–Automated Group expense and investment allocations(自动的开支分组和投资分摊)

•“Cash Formulas” allow construction of:(“现金流公式”允许建立:)

–Royalties(矿区使用费)

–Ring Fences(资产组平台)

–Cost recovery pools(成本回收池)

–Cost recovery limits(成本回收界限)

–Uplifts(上涨因素)

–Relinquishment(转让)

–R factor thresholds(R因子门槛值)

(R=Cumulative Revenue/Total Cumulative Expenses)

–ROR Systems(收益率系统)

–Profit oil splits(收益油劈分)

–Tax & Income tax(税和收入税)

–Tranche (various)(不同收益期望的投资的处理)

–Tax over price(暴利税)

简体中文

简体中文 English

English